HARRIERS REST

Home 38 -

Set as house type default

Sold

Its unique design makes this three bedroom semi-detached home stand out from the crowd.

Bedroom

Bathroom

2 parking spaces

Interested in this home?

Requesting an appointment is the best way to ensure you don't miss out.

Our sales office will be open by appointment only. To arrange an appointment, please contact Edward Stuart on 01733 942000.

More information on this home

Summary

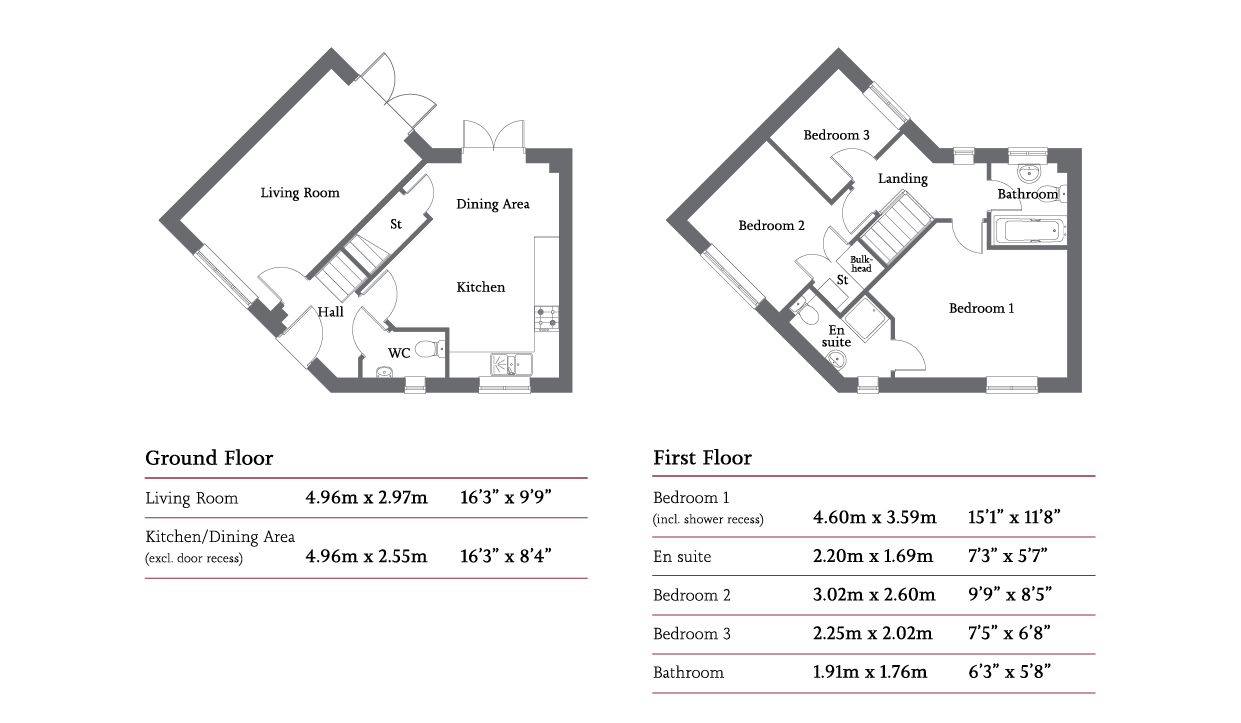

This three bedroom property is ideal for buyers looking for something a bit different. Entering the property there is a hallway leading to a large living room on one side and an open plan kitchen/dining area on the other.

The largest of the three bedrooms has an en suite. Bedroom three is at the rear of the house opposite the family bathroom.

– Did you know you could save £2,000* when buying a new home?

‘The Home Builders Federation (HBF)’s latest report – Watt a Save – has quantified this. The report’s findings show that new build homes save residents an average of £2,000 a year on their energy bills – this is even more if you look at just houses rather than include flats and bungalows. The report also suggests that fewer than four per cent of existing dwellings can match the EPC B rating or higher that new builds, Allison Homes included, commonly achieve.’

View information about the local areaKey features

- > Allocated parking

- > Bedroom 1 with en-suite

- > Kitchen/dining area with French doors

- > Living room with French Doors to rear

- > Private garden

Home Disclaimer

Calculate your budget

Calculate how much you could spend on your dream home